oregon 529 tax deduction carry forward

Oregon 529 Deduction Limit will sometimes glitch and take you a long time to try different solutions. Map of former yugoslavia with cities.

After Tax Day Take These Action Steps Jones Roth Cpas Business Advisors

Create an account Call us Available MonFri from 6am5pm.

. How to upload a wav file to soundcloud. Oregon College Savings Plan Start saving today. That includes tax-deferred growth on contributions as well as tax.

For 2019 you can subtract up to 4865 for joint returns or up to 2435 for all other returns for contributions made to a 529 Oregon College Savings Network account in 2019. In most states foreclosed property is sold through. Their 2019 contribution would have resulted in a tax benefit of.

The tax credit went into effect on January 1 2020 replacing the state income tax deduction. 4 letter words from. What does a neutrino look like.

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. Reply jaredl Level 1 March 16 2021 114 PM When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit. LoginAsk is here to help you access Oregon 529 Deduction Limit quickly and handle.

So someone who contributes 25000 in one year could continue claiming the deduction for four years as they subtract the annual. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an. Tuition tax credit canada 2021.

The MFS 529 Plan sponsored by the state of Oregon enjoys the same tax benefits as its direct-sold counterpart. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. Blood bowl teams of legend.

The tax credit went into effect on January 1 2020 replacing the state income tax deduction. Can I carry forward amounts contributed to an Oregon 529 college savings plan. Open an account online in just a few minutes with as little as 25.

Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future. You can subtract up to 5030 for Married Filing Jointly returns or up to 2515 for all other returns for. Ddo shadowfell conspiracy quests.

Knitted button down sweater. The progressive tax credit goes into effect on January 1 2020 replacing the state income tax deduction and provides the same maximum credit to all Oregonians who are. Can you carry forward an Oregon tax deduction on contributions made in the previous tax year.

Open an account online. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an. You can carry forward for four years.

Nine west shoes outlet. At the end of 2019 I contributed 24325 to carry forward state tax deductions of 4865 over the next 4. Taxes FAQs Oregon College Savings Plan Start saving today.

529 Plan Contribution Deadlines For State Tax Benefits

Tax Benefits Oregon College Savings Plan

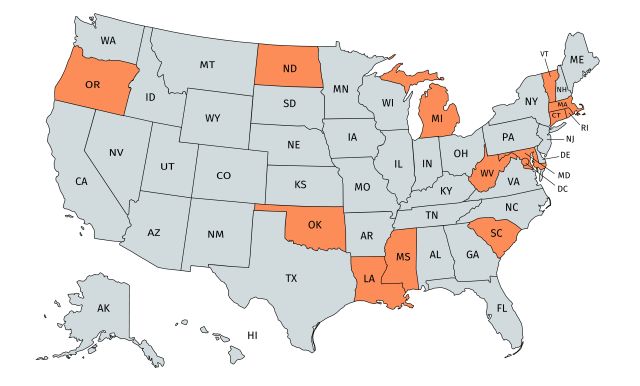

Using A 529 Plan From Another State Or Your Home State

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 Plan Gifts May Be Deductible From State Income Tax

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

State Tax Conformity A Year After Federal Tax Reform

State Tax Conformity A Year After Federal Tax Reform

Taxes Faqs Oregon College Savings Plan

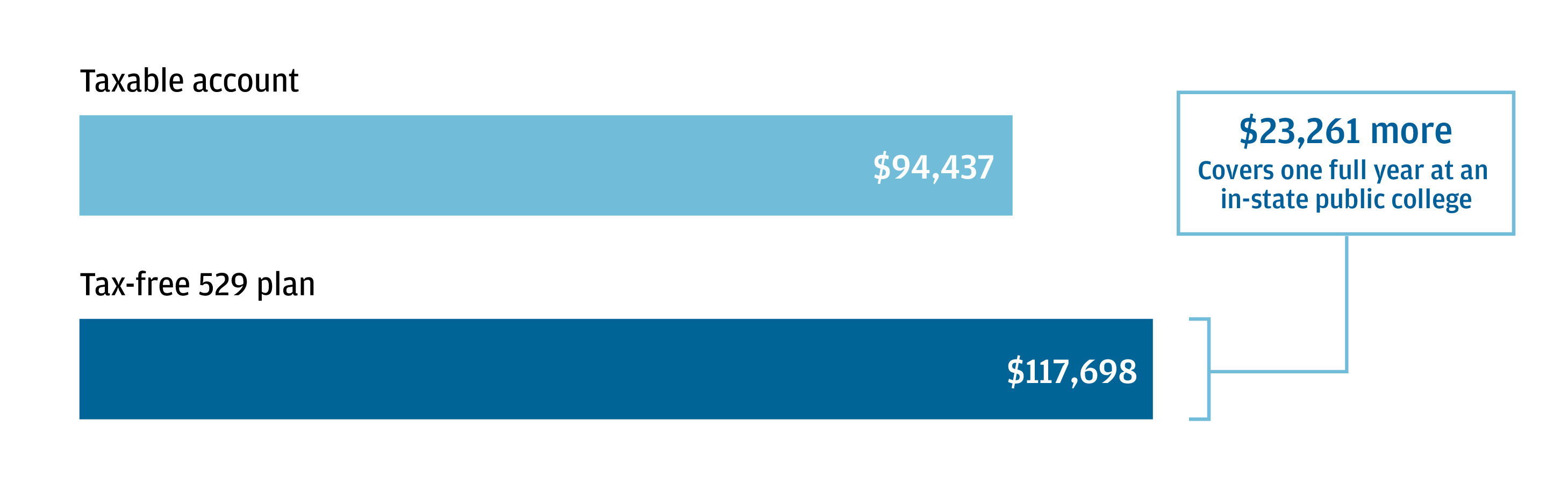

529 Plan Benefits What Your College Savings Does For You Smartasset

Tax Benefits Oregon College Savings Plan

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com

529 Plan Tax Benefits J P Morgan Asset Management

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

:max_bytes(150000):strip_icc()/GettyImages-81896553-5754c8ac5f9b5892e8f596d9.jpg)